are political donations tax deductible uk

The same goes for campaign contributions. This website offers information on are donations to political parties tax deductible uk.

Tnt Post S Infographic Our Donations What Who And Why Infografia Solidaridad

S341 Income Tax Trading and Other Income Act 2005 S541 Corporation Tax Act 2009.

. To be allowable for tax purposes expenses must be incurred wholly and exclusively for the purpose of the trade. If you made a contribution to a candidate or to a political party campaign or cause you may be wondering if your political contributions are tax deductible. Political candidates or political causes may also solicit your support.

HMRC does not generally consider this to be the case for political donations although there may be a case to argue in some very limited circumstances. Individuals may donate up to 2800 to a candidate committee per election up to 5000 per year to a PAC and up to 10000 per year to a local or district party committee. Regardless of whether a political contribution is made in the form of money or an in-kind donation it is not tax-deductible.

The tax goes to you or the charity. However in-kind donations of goods to qualified charities can be deductible in the same way as cash donations. While political contributions arent tax-deductible many citizens still donate money time and effort to political campaigns and to.

These donations arent tax-deductible nor can you use funds from a DAF or a QCD. So enjoy reading the articles on are donations to. Zee March 2 2022 Uncategorized No Comments.

Nonprofit Tax Programs Around The World Eu Uk Us Are Political Contributions Tax Deductible H R Block 63stfuv Kpqwm Difference Between Charity Business Administration Think Tank Not For Profit Definition Share this post. Individuals can contribute up to 2800 per election to the campaign committee up to 5000 per year for PAC and up to 10000 per year for local or district party committees. You should disallow payments to political funds contributions to party funds and expenses of candidates at elections etc.

Note that even though political donations are not tax-deductible there are limits to how much money can be donated for political purposes. This change allows individual taxpayers to claim a deduction of up. The federal government allows various deductions that can help reduce your taxes but this does not include your political contributions to the campaigns of any organization or.

If youre wondering what your current contributions to a political campaign party or even cause mean for your taxes youre not alone heres what you need. While charitable donations are generally tax-deductible any donations made to political organizations or political candidates are not. Though giving money to your candidate of choice is a great way to get involved in civic discourse donations to political candidates are not tax-deductible.

These organizationspeople are often candidates for office political parties or their organizational committees political action committees or organizations that promote or oppose a specific candidate or policy. Political Contributions Are Tax Deductible Like. The answer is no donations to political candidates are not tax deductible on your personal or business tax return.

According to the IRS. You cant deduct contributions to organizations that arent qualified to receive tax-deductible contributions including political organizations and candidates. Except that for 2020 you can deduct up to 300 per tax return of qualified cash contributions if you take the standard deduction.

The tax implications of political donations are often problematic. Even though political contributions are not tax-deductible there are still restrictions on how much individuals can donate to political campaigns. How this works depends on whether you donate.

As regards propaganda of a. An individual may donate up to 2800 to a candidate committee in any one election up to 5000 to a PAC annually up to 10000 to a local or district party committee annually and up to 35000 to a national party committee. Things To Know.

Straight from your wages or pension through a. Subscriptions for general charitable purposes and those to for. Are political donations tax deductible uk Are Donations to Political Campaigns Tax Deductible.

Following tax law changes cash donations of up to 300 made this year by December 31 2020 are now deductible without having to itemize when people file their taxes in 2021. Although political contributions are not tax-deductible there is always a limit to the amount that can be contributed to a political campaign.

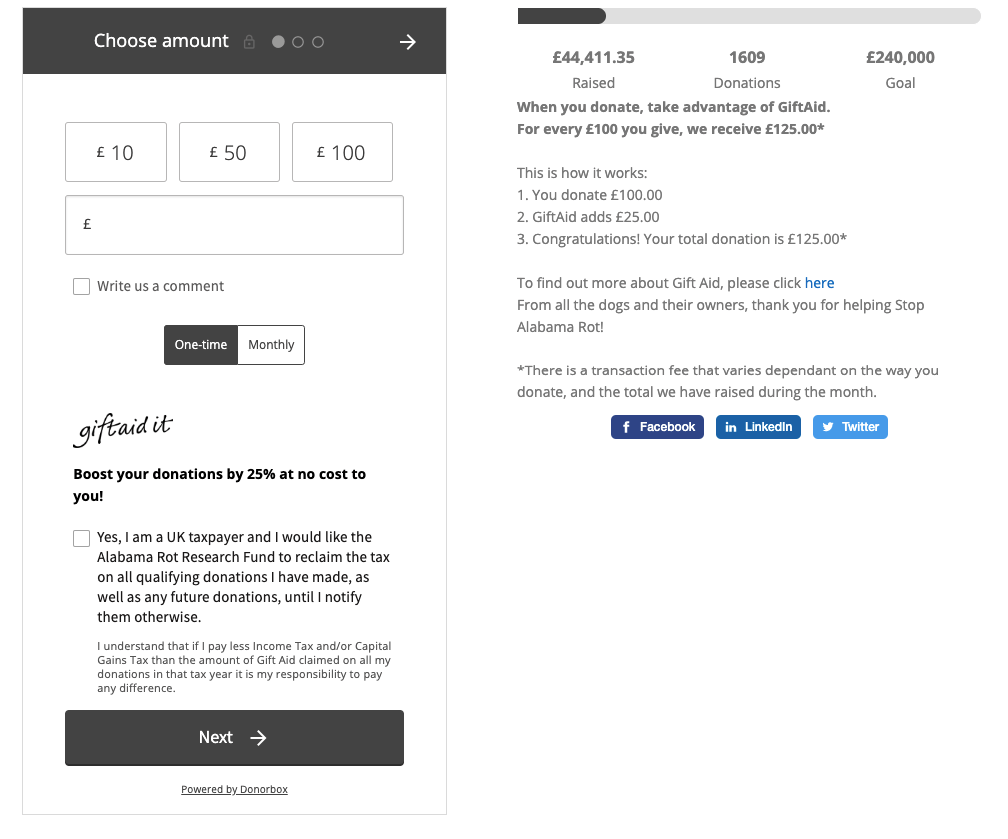

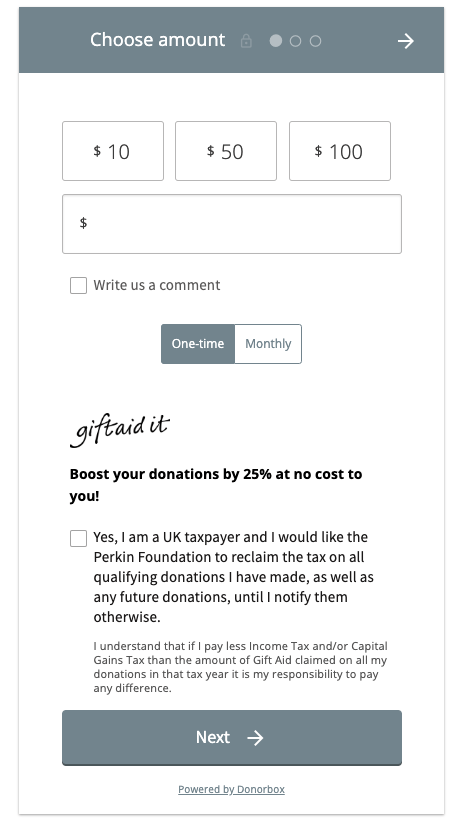

A Complete Guide To Gift Aid For Uk Based Charities Donorbox

36 Free Donation Form Templates In Word Excel Pdf Within Donation Card Template Free Cumed Org Donation Form Sponsorship Form Template Card Template

Why We Need To Stop Talking About Volunteer Programmes Volunteer Programs Volunteer Management Volunteer

Nonprofit Tax Programs Around The World Eu Uk Us

Tax Deductions For Donations In Europe Whydonate

Canadian Tax Return Check List Via H R Block Ca Http Www Hrblock Ca Documents Tax Return Do Small Business Tax Deductions Tax Prep Checklist Business Tax

Tax Deductions For Donations In Europe Whydonate

A Complete Guide To Gift Aid For Uk Based Charities Donorbox

58 Fi Special Education Fape Education Special Education Law Student

Tax Deductible Donations Can You Write Off Charitable Donations

New Tax Regime Disincentivises Charity Donations Says Study Business Standard News

Official 2022 Trump Donor Wall

Rules For Funding For Political Parties The Institute For Government

Rules For Funding For Political Parties The Institute For Government

Nonprofit Tax Programs Around The World Eu Uk Us

Donate Crypto And Lower Your Tax Bill Koinly

Deductible Or Not A Tax Guide A 1040 Com A File Your Taxes Online Business Tax Tax Write Offs Business Bookeeping

Tnt Post S Infographic Our Donations What Who And Why Infografia Solidaridad