net investment income tax 2021 proposal

Your net investment income is less than your MAGI overage. High-income taxpayers face a 38 net investment income tax NIIT thats imposed in addition to regular income tax.

Income Tax Calculator Facebook Will Before Long Change Its Name Another Report Proposes As It Looks To Show That It Has Extended In 2021 Income Tax Income Calculator

High-income taxpayers face a 38 net investment income tax NIIT thats imposed in addition to regular income tax.

. Jun 20 2021 Blog Individual Taxes Taxes. The NIIT applies to you only if modified adjusted gross income MAGI exceeds. Plan ahead for the 38 Net Investment Income Tax.

For estates and trusts the 2021 threshold is 13050 Definition of Net Investment Income and Modified Adjusted Gross Income. Net operating losses would no longer be accounted for in determining NII. Highincome taxpayers face a 38 net investment income tax NIIT thats imposed in addition to regular income tax.

In general net investment income for purpose of this tax includes but isnt limited to. Net Investment Income Tax NIIT on S Corp Profits If MAGI exceeds 500000 for a joint filer or 400000 for a single filer S Corporation profits will be subject to the 38 NIIT. The net investment income tax or NIIT is an IRS tax related to the net investment income of certain individuals estates and trusts.

The limit of the Section 199A deduction in the bill is not as restrictive as that proposed by Senate Finance Committee Chairman Ron Wyden D-OR in the Small Business Tax Fairness Act introduced in July 2021. Senator Wydens proposal removes the specified service trade or business and W-2-wagecapital investment limitations but phases. July 7 2021.

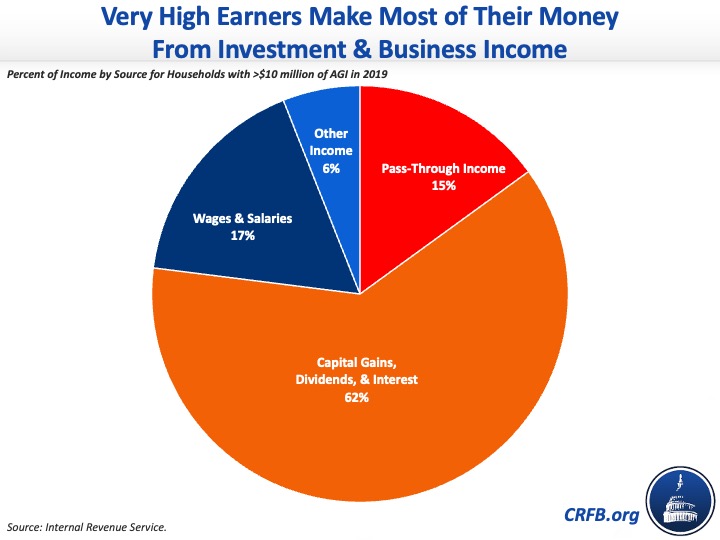

Trusts are hit hard The 38 surtax kicks in at much lower income levels for trusts. The proposal would i ensure that all pass-through business income of high-income taxpayers is subject to either the Net Investment Income Tax NIIT or Self-Employment Contributions Act SECA tax ii make the application of SECA to partnership and LLC income more consistent for high. This expands the net investment income tax to cover net investment income derived in the ordinary course of a trade or business for high-income taxpayers.

All other threshold amounts are NOT indexed for. NET INVESTMENT INCOME. Fortunately there are some steps you may be able to take to reduce its impact.

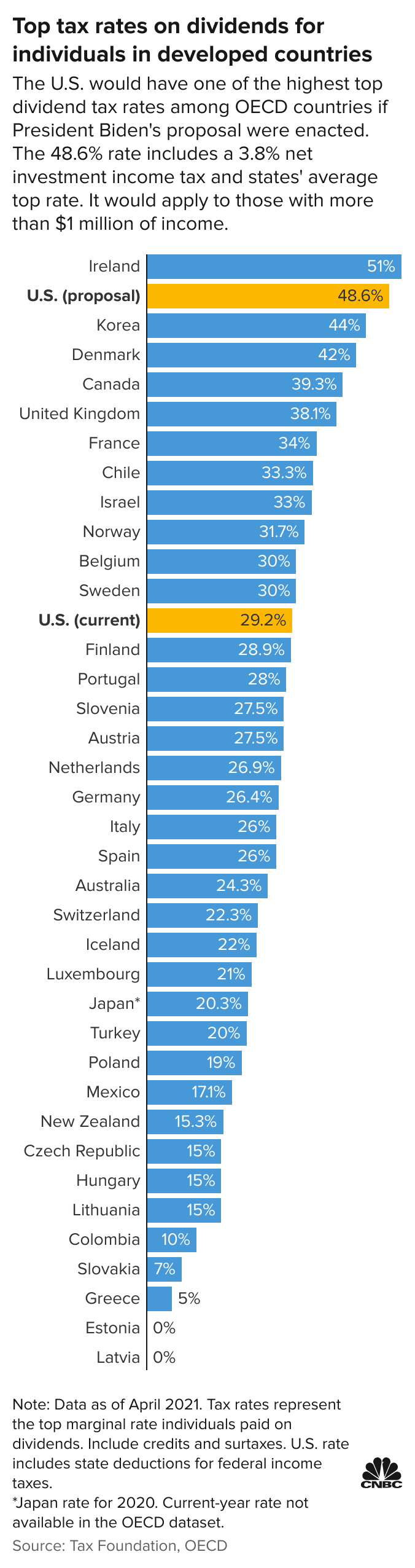

A special transition rule provides that the proposed maximum tax rate of 25 percent would only apply to qualified dividends and long-term capital gains realized after September 13 2021. The threshold for trusts and estates is the amount at which the top trust tax bracket takes effect. If an individual has income from investments the individual may be subject to net investment income tax.

Application of Net Investment Income Tax to Trade or Business Income of Certain High Income Individuals. Youll owe the 38 tax. Plan Ahead for the 38 Net Investment Income Tax Posted on July 27 2021 by Brady Ramsay High-income taxpayers face a 38 net investment income tax NIIT thats imposed in addition to regular income tax.

The adjusted gross income over the dollar amount at which the highest tax bracket begins for an estate or trust for the tax year. In Income Tax Individual Tax Tax Tips. The NIIT applies to you only if modified adjusted gross income MAGI exceeds.

Plan ahead for the 38 Net Investment Income Tax. Instead based on our reading of the latest proposal we are left with the following material changes to current tax laws. Can push taxpayers over the income threshold and cause investment income to be subject to the 38 surtax.

High-income taxpayers face a 38 net investment income tax NIIT thats imposed in addition to regular income tax. Fortunately there are some steps you may be able to take to reduce its impact. Net investment income tax.

The NIIT applies to you only if modified adjusted gross. All About the Net Investment Income Tax. High-income taxpayers face a 38 net investment income tax NIIT thats imposed in addition to regular income tax.

The Build Back Better Act proposes the new net investment income NII to be 38 tax for trade or business income for taxpayers earning more than 400000 annually 500000 for married filing jointly. Your additional tax would be 1140 038 x 30000. Of particular importance for sellers the surcharge on income in excess of the applicable thresholds coupled with the expansion of the 38 net investment income tax to apply to gain from the sale of limited partnerships or S corporations could increase the tax liability on a portion of the gain recognized for transactions that close during 2022 or later by as much as.

However in determining his self-employment tax T cannot use the FEIE amount to reduce his self-employment. Increase federal employment taxes and Net Investment Income Tax. Fortunately there are some steps you may be able to take to reduce its impact.

1 2013 individual taxpayers are liable for a 38 percent Net Investment Income Tax on the lesser of their net investment income or the amount by which their modified adjusted gross income exceeds the statutory threshold amount based on their filing status. Jun 4 2021 Individual Tax. This imposes a 3 tax on.

Surcharge on High Income Individuals Trusts and Estates. More specifically this applies to the lesser of your net investment income or the amount by which your modified adjusted gross income MAGI surpasses the filing status-based thresholds the IRS. Assume his net earnings from self-employment are US208700.

For income tax purposes T can reduce his taxable income by the FEIE amount for tax year 2021 the FEIE is US108700 meaning only US100000 will be subject to income tax. The NIIT applies to you only if modified adjusted gross income MAGI exceeds. Lets say you have 30000 in net investment income and your MAGI goes over the threshold by 50000.

But youll only owe it on the 30000 of investment income you havesince its less than your MAGI overage. This tax only applies to high-income taxpayers such as single filers who make more than 200000 and married couples who make more than 250000 as well as certain estates and trusts. Fortunately there are some steps you may be able to take to reduce its impact.

Plan ahead for the 38 Net Investment Income Tax. Fortunately there are some steps you may be able to take to reduce its impact. Fortunately there are some steps you may be able to take to reduce its impact.

Plan ahead for the 38 Net Investment Income Tax. This amount is 13050 in 2021. Single individuals with modified adjusted gross incomes in excess of 200000 and married individuals filing jointly with modified adjusted.

High-income taxpayers face a 38 net investment income tax NIIT thats imposed in addition to regular income tax. The net investment income tax NIIT is a 38 tax on investment income such as capital gains dividends and rental property income.

Real Estate Investment Funding Proposal Writing A Business Proposal Business Proposal Sample Real Estate Investing

Policymakers Shouldn T Weaken Build Back Better Surtax Committee For A Responsible Federal Budget

House Democrats Tax On Corporate Income Third Highest In Oecd

School Funding Request Sample Proposal Business Proposal Examples Proposal Business Proposal

Pass Through Entity Owners Bear The Hit With Proposed Federal Tax Law Changes

Biden S Plan Raises Top Capital Gains Tax Rate To Among Highest In World

Reconciliation Bill Capital Gains Tax Proposals Tax Foundation

Seven Federal Tax Areas Businesses Should Be Focusing On During Year End Planning

Tax Facts On Individuals 127th Edition Ebook In 2021 Business Ebook Health Insurance Humor Small Business Accounting

Like Kind Exchanges Of Real Property Journal Of Accountancy

What Is The The Net Investment Income Tax Niit Forbes Advisor

Ulip Is Taxable Tax Free Investments Start Up Business Income Tax

To Book A Free Consultation With Our Web Design And Digital Marketing Specialists Go To Calendly Com Dkwd In 2021 Web Design Web Design Services Web Design Company

Capital Budgeting Introduction Techniques Process In 2021 Budgeting Budgeting Process Financial Health

Explore Our Image Of Trade Proposal Template Proposal Templates Business Investment Business Proposal Template

12 Weeks To Freedom By Gordon Jay Alexander In 2021 Jay Alexander How To Find Out Make A Proposal

Free Editable Startup Funding Proposal Template Word Template Net Startup Funding Proposal Templates Up Proposal

6 Free Simple Business Plan Template Every Last Template Free Download Simple Business Plan Template Business Plan Template Free One Page Business Plan